do you pay taxes on inheritance in colorado

The first rule is simple. The IRS generally excludes gifts.

Eight Things You Need To Know About The Death Tax Before You Die

The 2017 tax reform law raised the federal estate tax exemption considerably.

. This really depends on the individual. Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. The Basic Rule.

Federal Estate Tax Exemptions For 2022. Thats because federal law doesnt charge any. There is no federal inheritance tax.

After you die someone will become responsible for taking over your estate and determining whether it owes any estate taxes. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. There is no inheritance tax or estate tax in colorado.

In other words when an. How much tax do you pay on inheritance. If you receive property in an inheritance you wont owe any federal tax.

The good news is that since 1980. Inheritance tax is a tax paid by a beneficiary after receiving inheritance. They may have related taxes to pay for example if.

If the inheritance tax rate is 10 and you inherit 100 you pay 10 in inheritance tax. Thats an increase from last year. If it does its up to.

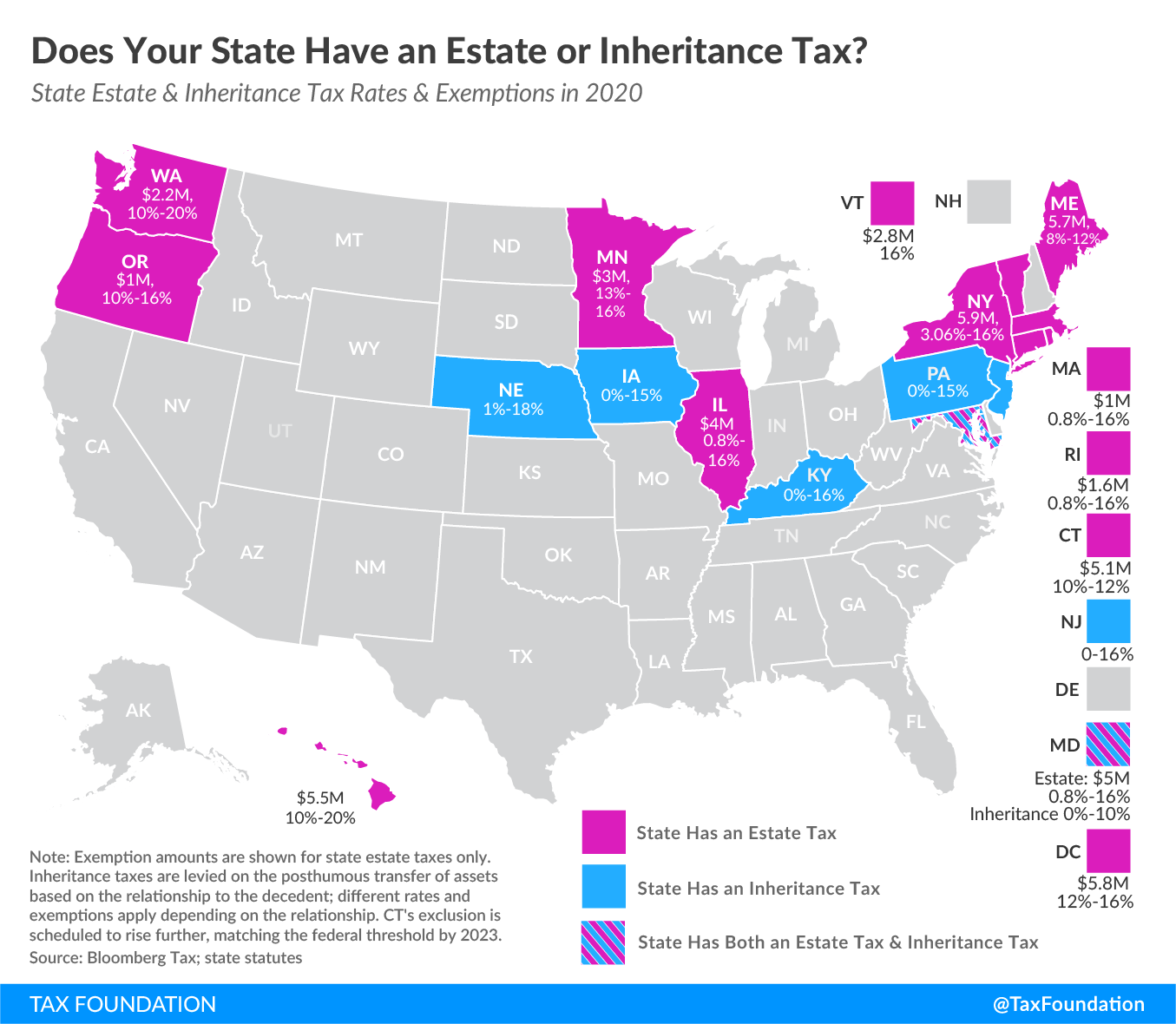

Colorado Form 105 Colorado Fiduciary Income Tax Return is the Colorado form for estate income taxes. The federal government doesnt charge. Although there is no federal tax on it inheritance is taxable in 6 states within the US.

Before that law was enacted the exemption. Do you have to pay taxes on 5000 inheritance. An inheritance can be a windfall in many waysthe inheritor not only gets cash or a piece of property but doesnt have.

As of 2019 the federal tax exemption on estate taxes is 114 million. Married couples can exempt up to 234. The following are the federal estate tax exemptions for 2022.

Individuals can exempt up to 117 million. Ad Inheritance and Estate Planning Guidance With Simple Pricing. The tax in these states ranges from 0 to 18.

415 46 votes There is no estate or inheritance tax collected by the state. Our free Colorado paycheck calculator can help figure out what your take home pay in the Centennial State will be. There is no federal inheritance tax but there are a handful of states that impose state level.

A state inheritance tax was enacted in Colorado in 1927. Colorado Inheritance Tax and Gift Tax. How much tax do you pay on inheritance.

However Colorado residents still need to understand federal estate tax laws. This means that if your inheritance property is worth less than that you. Until 2005 a tax credit was allowed for federal estate.

How does inheritance tax work for Colorado residents. If you think youre going to get hit with sizable inheritance and estate taxes you might want to give away some of your assets before you die. First estate taxes are only paid by the estate.

How much tax do you pay on inheritance. Inheritance taxes are taxes that apply directly to any property you receive as an inheritance. Inheritances Arent Taxed as Income.

Technically there is only one case where a Colorado resident would have to pay an inheritance tax. It happens only if they inherit an. When it comes to federal.

Where Not To Die In 2022 The Greediest Death Tax States

How To Stop Wage Garnishment For Federal Student Loans Cleveland Irs Taxes Tax Debt Wage Garnishment

Don T Die In Nebraska How The County Inheritance Tax Works

We All Need Plans To Minimize State And Federal Estate Taxes And These Plans Are Best Structured By A Profession Estate Tax Estate Planning Financial Services

I Just Inherited Money Do I Have To Pay Taxes On It

Colorado Estate Tax Everything You Need To Know Smartasset

Nevada Facts Map And State Symbols Enchantedlearning Com Nevada Nevada Travel Nevada Map

Got A Will Here Are 11 More End Of Life Documents You May Need

Gift Tax How Much Is It And Who Pays It

Inheritance Tax Here S Who Pays And In Which States Bankrate

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Colorado Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Do I Pay Taxes On Inheritance Of Savings Account

12 States That Tax Social Security Benefits Kiplinger Social Security Benefits Social Security Inheritance Tax

How To Do A Backdoor Roth Ira Contribution Safely Roth Ira Contributions Roth Ira Ira