does wyoming charge sales tax on labor

Additionally Oklahomas manufacturing exemption provided by Okla. Wyoming has no corporate income tax at the state level making it an attractive tax haven for incorporating a business.

Auto repair shops often provide the necessary parts as well as the labor for the repair.

. If services fall under the states sales tax rules auto. In most states services including construction labor are still considered a non-taxable service. And its generally not charged on labor such as accounting services or you guessed it construction.

I filed my Federal tax this weekend. Oklahoma does not provide an exemption from sales and use tax for materials or equipment used in the production of oil and gas. Groceries and prescription drugs are exempt from the Wyoming sales tax.

The Excise Division is comprised of two functional sections. Tax Bracket gross taxable income Tax Rate 0. Top of page.

In the US sales tax is generally charged on tangible personal property such as a toothbrush or a lamp. With lump-sum contracts all materials supplies labor and other charges are added together to create one price. What is the sales tax in Arizona 2021.

Unlike Wyoming which charges its highest property taxes on the mineral industry Montana does not levy a property tax on oil gas or coal holdings. This reference is here to help answer your questions about what is and is not subject to the New Mexico sales tax. Arizona has state sales tax of 56 and allows local governments to collect a local option sales tax of up to 53.

Wyomings sales tax is the 44th lowest in the nation and its tax on beer is the 50th unchanged since 1935 when it was set at 002 a gallon. If a state treats contractors as a reseller you dont pay sales tax when you purchase construction materials. Free Unlimited Searches Try Now.

Under certain circumstances labor charges are taxable. Municipal governments in Wyoming are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with an average local tax of 1472 for a total of 5472 when combined with the state sales tax. But generally is the operative term here.

68 135215 states that extractive and field processes for oil and gas production are not deemed to be manufacturing processes. I owe 1700 and I. Labor charges to construct or repair immovable or real property are not subject to sales tax.

In Wyoming certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Wyoming corporations still however have to pay the federal corporate income tax. I owe 1700 and I said I would pay it on April 7.

Wyoming Use Tax and You. For this example we will say that you normally charge a 15 markup on your materials. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547.

10 -Wyoming Corporate Income Tax Brackets. State law sets the rules for what types of sales are taxable and might include labor. You can look up the local sales tax rate with TaxJars Sales Tax Calculator.

There are several exemptions to the state sales. According to the federal Bureau of Labor. State wide sales tax is 4.

Do I have to collect sales tax on charges for labor. You will also charge for labor and 8 sales tax on the entire charge. In addition Local and optional taxes can be assessed if approved by a vote of the citizens.

While the Wyoming sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. Time-and-materials contracts are itemized with the customer paying separate charges for labor supplies materials etc. This page discusses various sales tax exemptions in Wyoming.

See the publications section for more information. Specifically businesses are required to pay use tax on labor they use in the course of their business. Then I found a statement from my brokerage I had omitted so I amended my return and ended up owing 550 more.

I filed my Federal tax this weekend. The state sales tax rate in Wyoming is 4. Fees for labor are taxed when the labor is expended on a taxable item ie repairs to a vehicle.

There are a total of 101 local tax jurisdictions across the state collecting an average local tax of 2132. The maximum local tax rate allowed by Wyoming law is 2. However there are cases where the business itself is liable for paying what seems to be sales tax on labor.

Sales tax for example is a common state-level tax that businesses charge customers and collect for the state. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the purchase price are also subject sales tax. Sales tax 8 5260.

5750 which includes your markup Labor 60000. In Wyoming there are currently no statutory provisions to impose sales or use taxes on professional services provided that they do not include any sales of or repairs alterations or improvements to tangible personal property in the scope of those services. Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6.

The vehicle was a taxable item hence labor to repair it is taxable This would also apply to appliances jewelry and any other taxable items. In Cheyenne for example the county tax rate is 1 for Laramie County resulting in a total tax rate of 5. Wyoming has a statewide sales tax rate of 4 which has been in place since 1935.

Labor charges to install or repair items that become part of real estate are not taxable. Sales Tax Exemptions in Wyoming. This only occurs in certain.

Ad Lookup WY Sales Tax Rates By Zip. Labor to fabricate or repair movable property is taxable.

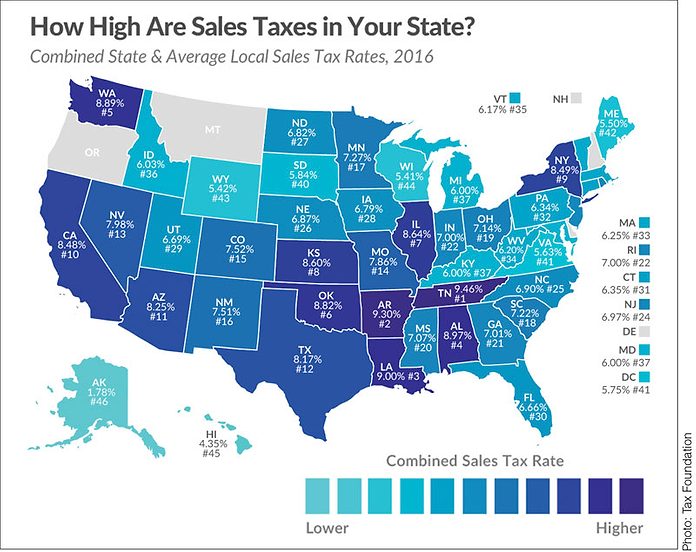

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Wyoming Sales Tax Handbook 2022

Avoid Penalties By Staying Aware Of Sales Tax Laws

Wyoming Sales Tax Guide And Calculator 2022 Taxjar

Wyoming Sales Tax Small Business Guide Truic

Sales Taxes In The United States Wikiwand

Ranking State And Local Sales Taxes Tax Foundation

Monday Map State And Local Sales Tax Collections Tax Foundation

How Does Wyoming S Tax Structure Compare To Other States Wyofile

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation